Back to Blog

Silicon Valley Bank and Silvergate: How Are NFTs Affected?

Eric Esposito

Mar 17th, 2023

.6 min read

Within a few days, Silicon Valley Bank (SVB) went from being one of America's biggest banks to the second-largest bailout in history. After depositors withdrew $42 billion in two days, the U.S. federal government swooped in to halt SVB's collapse. Then on March 17, 2023, SVB officially filed for Chapter 11 bankruptcy, aiming to find a buyer for its assets.

Due to SVB's size and close ties with tech startups, it has had an impact on the cryptocurrency space. So, how does the SVB situation affect the crypto and NFT markets?

What happened to Silicon Valley Bank?

Founded in the 1980s, SVB was a Santa Clara-based bank that catered to California’s bustling tech startup scene. Before SVB fell, it claimed to work with at least 50 percent of America's startup companies, including big names like Roku, Etsy, and Roblox.

SVB's startup-friendly approach helped it amass an impressive $209 billion in assets. To generate a return on these deposits, SVB decided to invest primarily in long-term government bonds and mortgage-backed securities. While this worked well when interest rates were zero, issues emerged when the U.S. Federal Reserve raised rates. Whenever interest rates rise, bonds lose their value. Hence, SVB's bonds were diminishing rapidly as the Fed increased its interest policy.

While SVB lost money in its bond portfolio, fewer startups were opening accounts in the higher interest rate environment. Since the interest payments on loans kept increasing, fewer venture capitalists or companies were doing business with SVB.

SVB planned to sell a portion of its portfolio and issue more shares to deal with this crisis. However, when news of this loss reached the stock market, SVB's shareholders dumped their stock from $267 to $165 in a day.

The selling pressure intensified as depositors withdrew $42 billion from SVB in 48 hours. Since most of SVB's money was in long-dated bonds, it couldn't meet this demand from depositors, which is why the FDIC had to take over SVB's operations.

Recent investigative reports suggest SVB's management knew the bank was in trouble and allegedly sold their stake days before SVB's downfall. However, at this time, it's unclear whether this will lead to insider trading charges.

What crypto and NFT projects have money at SVB?

Unlike the fall of Silvergate and Signature banks, SVB wasn't a "crypto-focused" bank. However, since SVB's involvement in Silicon Valley's tech scene was so extensive, many prominent crypto companies held accounts with the bank.

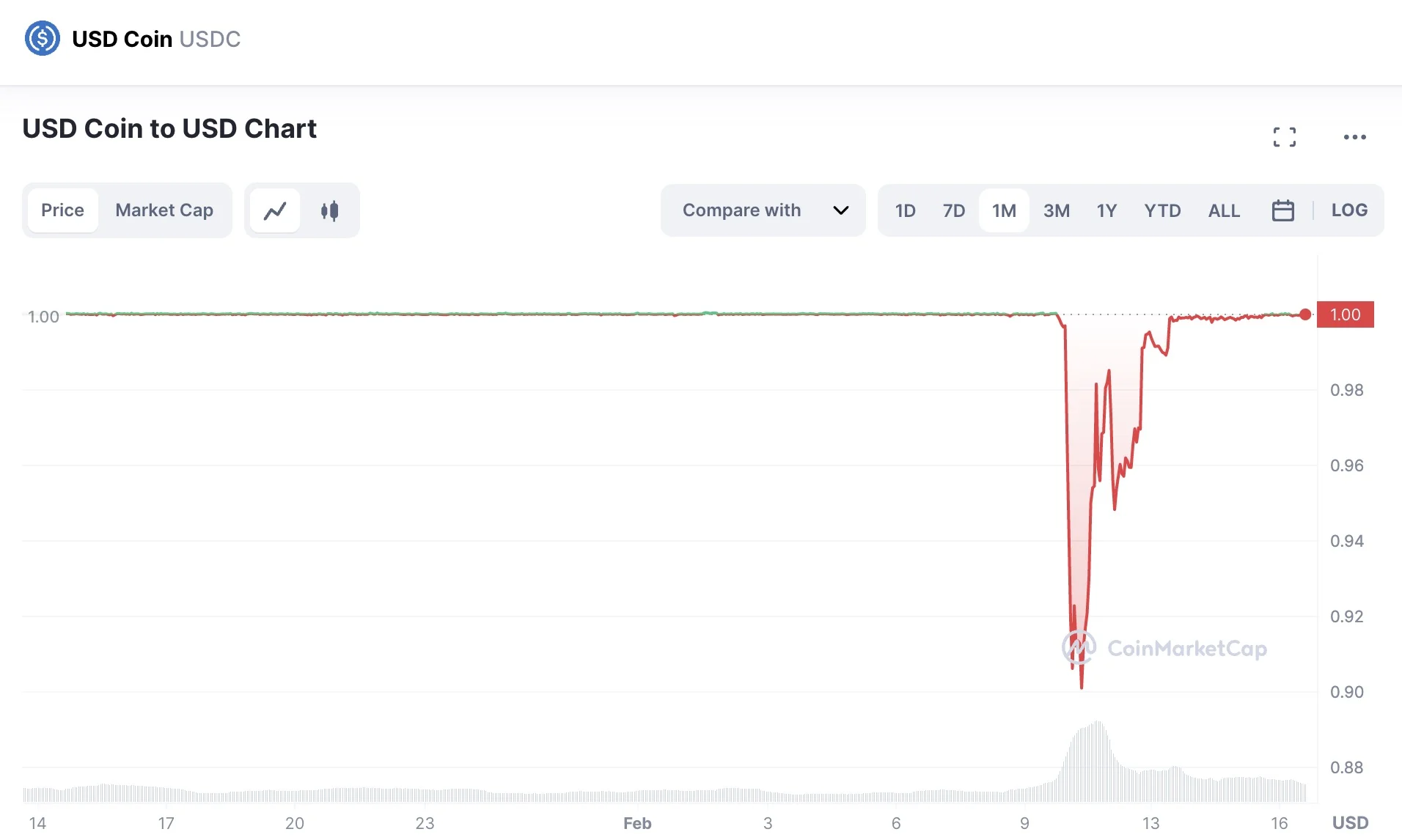

The fintech firm Circle was the most significant crypto company involved with SVB. Circle is best known for issuing the USDC stablecoin, which should always maintain a price of $1. However, since Circle had $3.3 billion tied up in an SVB account, it didn't have the reserves to back up its 1:1 USDC-to-USD ratio. For this reason, USDC fell to as low as $0.88 following news of SVB's collapse.

Luckily for the NFT sector, few prominent projects had significant savings in SVB. For instance, the Bored Ape Yacht Club's founder Yuga Labs said they had "super limited exposure" to SVB's collapse. Other prominent NFT projects like Azuki, Proof Collective, and Dapper Labs also said they had minimal funds with SVB.

Some NFT-related companies like Animoca Brands, DeGods, and Cool Cats had zero deposits in SVB. The Woodies NFT founder Chris Wallace even joked he didn't know SVB existed before the crash.

As for major cryptocurrency exchanges, nobody revealed exposure to SVB. Following news of SVB's failure, the CEOs of Binance, Kraken, and Crypto.com announced they had $0 at this bank.

Are NFTs safe after the SVB collapse?

Following other negative events like FTX's collapse and Silvergate's failure, crypto investors were on edge after hearing about SVB. The most pressing concern surrounded the USDC stablecoin. If the U.S. government didn't bail out SVB, USDC might have gone under. Since USDC is widely used throughout the crypto ecosystem—especially in NFT trading and decentralized finance — its failure would have had a "destabilizing" effect on the space.

Luckily, after the FDIC said it would help SVB's depositors, USDC quickly reclaimed its $1 peg. Also, as more crypto companies reported zero or minimal exposure to SVB, traders and investors had greater confidence in the space.

Again, it appears most NFT projects, markets, and companies don't have a significant amount of money in SVB. While new reports could emerge in the upcoming days, the NFT space should continue moving forward following this news.

Contrarian case: Could SVB be good for crypto?

Ironically, as the banking sector struggled, cryptocurrencies surged. Bitcoin rose from roughly $19,000 before SVB's fall to $26,000 a few days later. Altcoins like Ethereum, Solana, and Cardano also posted impressive gains.

While there are dozens of potential reasons for the rise in cryptocurrency, some analysts believe bank failures like SVB highlight the need for decentralized payment options. After all, Satoshi Nakamoto created Bitcoin during the financial crisis of 2008. As distrust grows towards traditional financial institutions, more people may be willing to invest in alternative assets like Bitcoin. Even Morgan Stanley admits SVB's fall may become Bitcoin's "shining moment."

Along with the growing distrust for banks, recent reports suggest the FDIC may inject up to $2 trillion into the economy, which may further increase inflation. As fiat currency continues to inflate, cryptocurrencies with a hard-cap supply (e.g., Bitcoin) or a deflationary issuance system (e.g., Ethereum) may become more attractive.

Arguably, some of the money from large institutions like SVB went into the cryptocurrency ecosystem. More people may be experimenting with decentralized finance applications to avoid traditional banks and exchanges.

Although crypto's rise after SVB's fall was impressive, it's still too early to say whether it represents a significant shift in the global financial system. Keep in mind Bank of America recently reported more than $15 billion in deposits as people left SVB. It's also unknown whether crypto would have shot up if USDC didn't recover its peg.

However, as more banks show signs of weakness, it's clear the use case of cryptocurrencies is becoming more prevalent. Ironically, Fidelity — one of the world's largest asset managers — launched its crypto trading platform during this banking chaos. The combination of greater accessibility and growing distrust for banks might speed up mainstream crypto adoption.

Bottom line: Can NFTs survive SVB's collapse?

SVB's fall could have been a lot worse for the crypto space. Countless projects and companies rely on Circle's USDC for trading or in their reserves. Therefore, a total collapse of this stablecoin would have been devastating for the Web3 industry. However, since USDC appears to be fine following SVB's bailout, the crypto space seems to be "back to normal."

On the downside, it may be more difficult for crypto projects and NFT collections to get easy funding in the post-SVB world. Many crypto venture capitalists got burned at SVB, and it's unknown how, when, or if they'll return to the Web3 space. The SVB drama may also re-ignite the quest to create a secure decentralized stablecoin.

Plus, there are questions about how crypto companies will process fiat payments following recent bank failures. Most notably, with the shutdown of Silvergate Bank, exchanges don't have access to its revolutionary 24/7 Silvergate Exchange Network (SEN). Since so many companies relied on the SEN, it may take time for platforms to make fiat-to-crypto transfers.

Much is uncertain in the economic world today, both traditional and surrounding crypto and Web3. However, unlike banking and stocks, Web3 is still in its nascent stage, and represents a crucial site of growth on unprecedented scales. While there are dangers, it would be inaccurate to say there aren't safe steps to take while investing in NFTs.

Related Posts

10 Unique Types of NFTs You Should Know in 2023

Profile pics are only one of many NFT categories. Discover the hottest NFT ...

Eric Esposito

Mar 15th, 2023

What Makes NFTs Valuable? From Community to Rarity, and More

Without value, NFTs wouldn't live for long. Here's why NFT value goes beyon...

Nick Fouriezos

Mar 13th, 2023

What Is an NFT Marketplace? A Must-Read Guide on OpenSea, Blur, and More

As a major epicenter for Web3 activity, NFT marketplaces are the future of ...

Brad Bergan

Mar 9th, 2023